Protel – Protel Smart – Ermis Pro

For the customization of the Protel Hotelsoftware family applications (Protel, Protel Smart, Ermis Pro) we have the following two possibilities:

SCENARIO A:

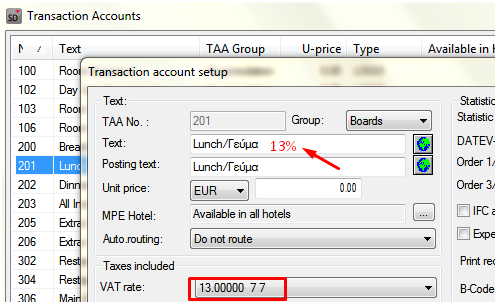

Use the same Transaction Accounts (TAA) by changing the VAT rate. from 24% to 13%, in the field VAT rate, as well as in the text of the section, if there is an indication.

After the end of the day on the 19thof May, you will need to change the VAT rate on the food package sections changing from 24% to 13%. From Protel System Data you choose Bookkeeping – Revenue and Payments – Transaction Accounts and by double-clicking you open the sections one by one and correct them.

ALL INCLUSIVE

If you use All Inclusive package, you should create new formula 20%, which will be used for the first time, and replace the 5% or 10% that you had in the package until now. The analysis of the remaining meals that make up the All Inclusive is irrelevant, as all the remaining sections (breakfast - lunch - dinner) are subject to the reduced VAT rate 13%.

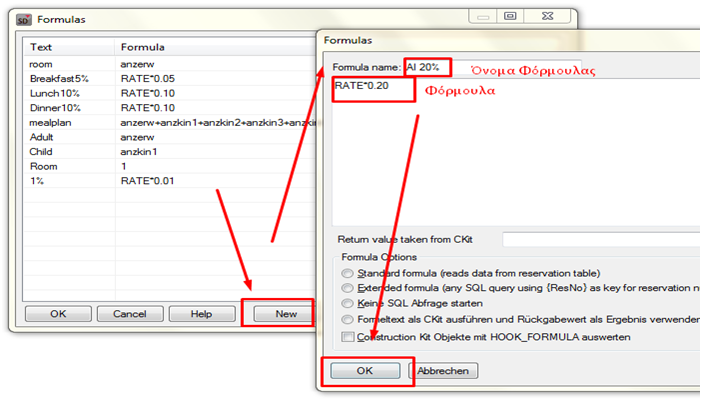

Process for creating a new Formula for use in ALL INCLUSIVE

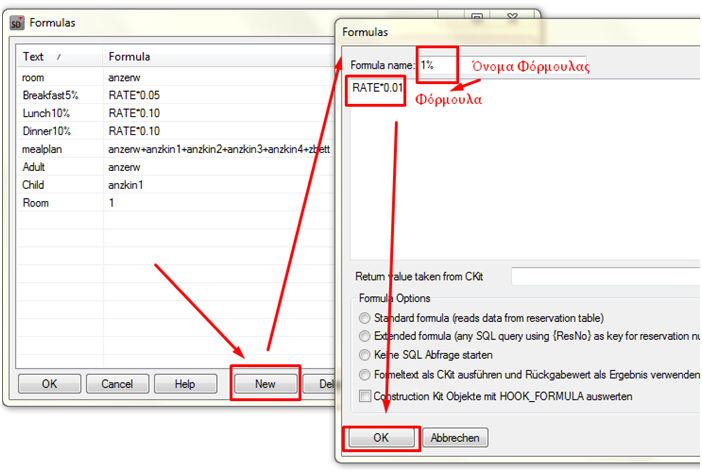

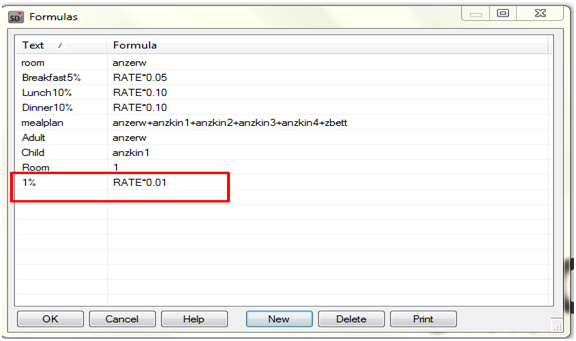

From the System Data selection Rates – Formulas, you choose NEW and enter the formula name and the formula. Save with OK.

The formula should have the following form: RATE*0.20 for 20%. RATE must be written in capital letters and a name of your choice.

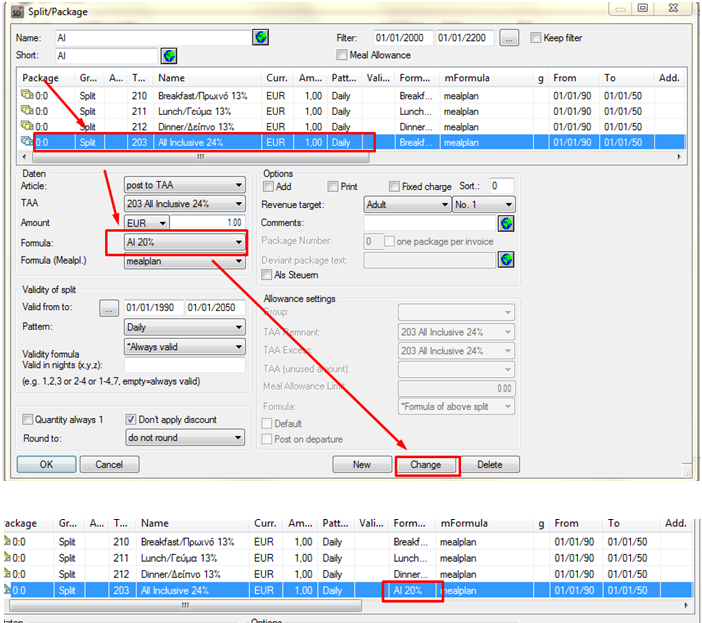

Then you correct the formula in the ALL INCLUSIVE package by Rates – Split Tables.

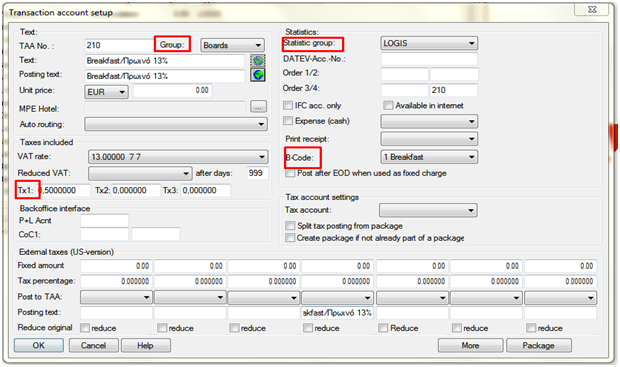

Creation of new departments with VAT 13% for food departments

In the food departments (Restaurants, Bars, etc.) you should have and section with 13%. Check if a correctly created section already exists, from an earlier use, otherwise create a new one by selecting NEW.

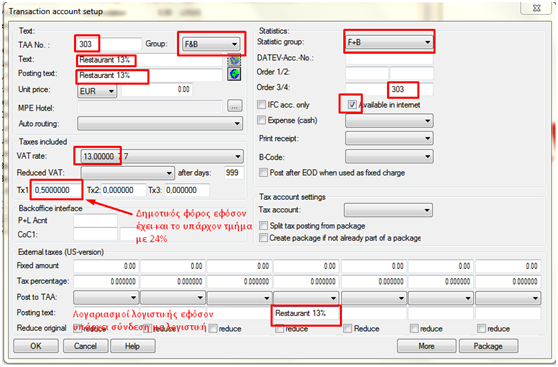

Before creating a new one, carefully observe the existing segment with 24% in all fields, so that the new segment only differs in TAA No. and everything else that characterizes the new VAT rate.

The creation of new food departments can be done before the start of the 20of May. If they already exist, please check their content.

NOTE: If there is a connection to accounting, the accounting accounts of the nutrition package departments should be updated in consultation with your accounting manager, when the update of the files is completed by May 19th.

In POS items that change VAT at the beginning of the year for the 20or May, in addition to the rate changing, the number of the new Protel branch will need to be updated.

SCENARIO B:

Create a new section with a coefficient of 13%. Also, there is a possibility that in your sections there is already a series of sections with 13% from earlier use, so you do not need to create new ones, simply check the correctness of the existing ones.

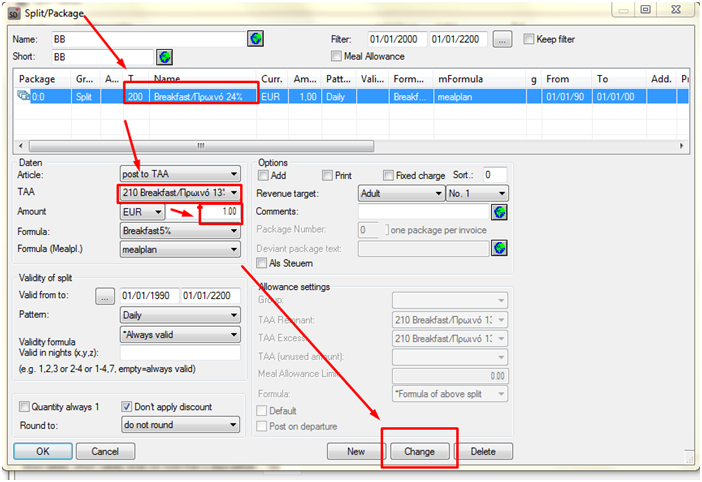

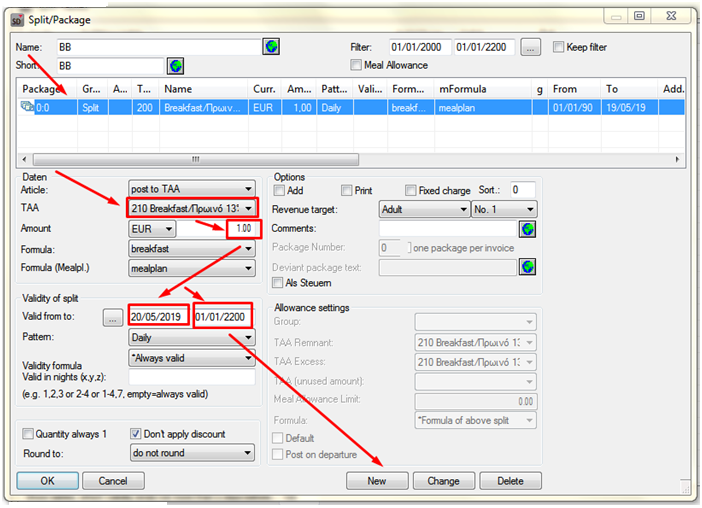

If you decide to create new sections for the nutrition packages, or activate existing ones from earlier use, you will need to correct the expiration date of the current registration (with the old section) within each package to 19/05/2019 and at the same time create a new registration with a start date of 20/05/2019 and an end date of 01/01/2200.

First you create the new sections. SD – Bookkeeping – Revenue and Payments – Transaction Accounts – New and enter the necessary information with VAT rate 13%.

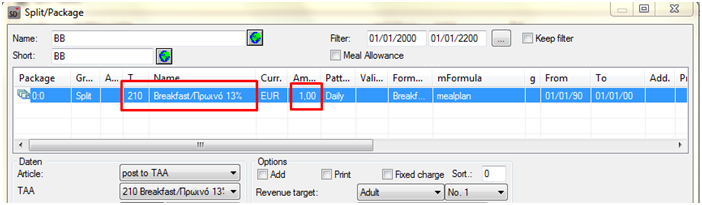

In the image below, in the highlighted fields you should select that it exists and in the corresponding section that will be removed.

Then, from the selection Rates – Split Tables double-click the package. In the package, select the section line, replace the old section with the new one, enter 1 in the position Amount because when changing the section it will be reset and you save with CHANGE.

Repeat the process for all packages, in all the records that make them up.

ATTENTION: If you are using a package All Inclusive, follow the paragraph “ALL “INCLUSIVE” from the SCENARIO A (here).

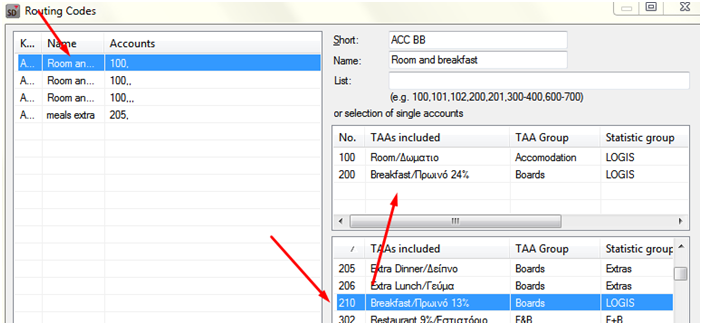

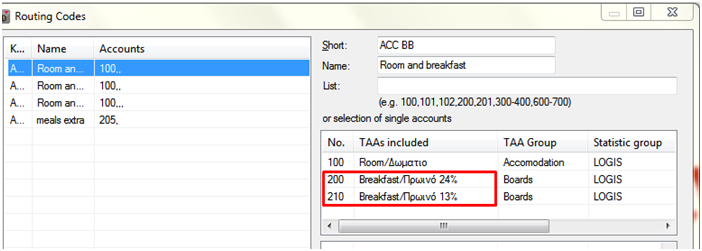

If you have enabled automatic Routing codes Instructions in price lists or Profiles, you will need to add the new meal plan sections to them.

From the SystemData – Bookkeeping – Invoice – RoutingCodes, you select the ready ones in order RoutingCodes and add the new sections, doing drug&drop from the bottom right to the top right window and saving with CHANGE.

You continue by creating a new record with the new section and in the details the difference is that the from date will be 20/05/19. You can create a new record by correcting the existing one and clicking NEW.

So, you will have two entries for each section, one with 24% and one with 13%.

Continue with the process. «Creation of new departments with VAT 13% for food departments" from the SCENARIO A.

Changing the decomposition rates

In case you want to change the breakdown rates in the nutrition packages, follow the following procedure to create a new formula for use in the nutrition packages:

From the System Data – Rates – Formulas, you choose NEW and enter the formula name and the formula. Save with OK.

The formula should have the following form: RATE*0.01 for 1%, RATE*0.04 for 4%, RATE*0.05 for 5%, RATE*0.10 for 10% and so on, with the name of your choice.

To use the formula you created in a diet plan, you must select Rates – Split Tables.

After completing the entire process, to activate the modifications, we close the application and open it again.