These Instructions concern installations located on the islands where the 30% VAT discount is abolished from 1/7/2018.

We recommend that you immediately inform yourself about the changes that dictate the calculation of VAT. POL 1061/2016 and 1063/2016 from your tax professional or accountant.

Account adjustment process

If you decide to issue all documents in 30/06/2018, then at the end of 30of June before closing and if you have completed the day's arrivals and departures, a prepayment for the 30th must be made to all remaining guests.or June.

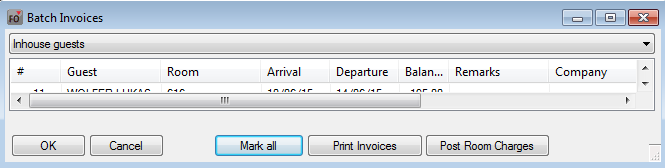

The process can be done through the customer's account with Advanced Invoice (for the next 1 day) or massively, by choice Cash Register – *Batch Invoices, selecting Inhouse Guests, Mark All and Post Room Charges. With this process, the agreed amount is charged to each account based on routing instructions and will not be charged again at the end of the day 31/5.

Batch Invoices – protel PMS

* This option is not available in the Protel Smart version and Ermis PRO.

Then, all invoices should be issued with a date of 30/06/2018, with a payment method of your choice. We proceed to closing on June 30th.

If you have installed P2L interface (bridge with accounting programs), It is correct to get the corresponding accounting records by the 30th.or June before the change in VAT rates and the corresponding accounting accounts.

Also, when the VAT changes (01-07-2018) in the departments (TAA) the corresponding ones should also be changed. accounting accounts, at the bottom of the window, to what the change affects.

VAT change actions (after the end of the day)

After the end of the day at 30/06/2018 and before charges are made for 01/07/2018, the following procedure should be followed:

- You should make sure that all Users are out of the program (disconnected).

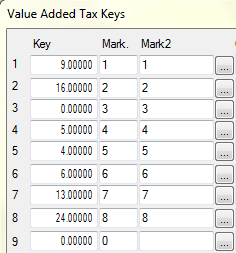

- You choose System Data – Taxes – VAT KeysIn the Key column, in the first blank row, fill in 6 and then in the following rows 13 and 24.

- In the column Mark2 enter that it also exists in the Mark(a/a) column, e.g. Key 7 = 13 Mark = 7 and Mark2 = 7, as shown in the image below.

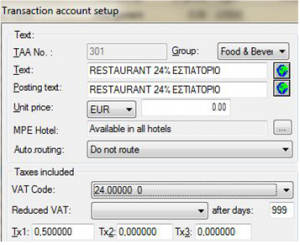

- You choose System Data – BookKeeping – Revenue And Payments – Transaction Accounts (TAA) and change the values in the sections in the selection VAT CODE.

Value Added Tax Keys

In all departments, in the corresponding field VAT CODE, where 9% change to 13% and where 17% change to 24%.

Also, corrections should be made to the sections mentioned in the description. VAT rate:

VAT rate

After completing the entire process, we close the protel and we open it again.

ATTENTION: After each correction, don't forget to press OK to save the change. The settings will take effect after restarting the program.

Correction of coefficients in documents

Please contact the HiT Support Department S.A. so that we can correct the factors in your document forms.

Check carefully the first bill printout after change of VAT rates. If differences arise in the printouts in the respective departments, contact the Support Department so that the corresponding adjustment can be made within a reasonable period of time.

Finally, if your business has symPOSium Web POS Suite and cash registers, you should refer to the corresponding VAT Change Instructions.

You can also find the above instructions HERE – in a .pdf file suitable for printing.

You follow the same process to change your VAT if you are a user of the application. Ermis Pro.

For any clarification, Support Department HiT S.A. is always at your disposal.